2025 in Review: Stories, Insights and Impact from Globe Media Group

Now that 2026 is underway, it’s the perfect time to reflect on a year that combined insight, creativity and audience engagement in new and powerful ways. In 2025, Globe Media Group launched initiatives that redefined how brands connect with news audiences, celebrated Canadian talent on the global stage, and expanded lifestyle reporting to reflect how Canadians live, spend, and express themselves. Here’s a look back at some of the projects and programs that defined the year.

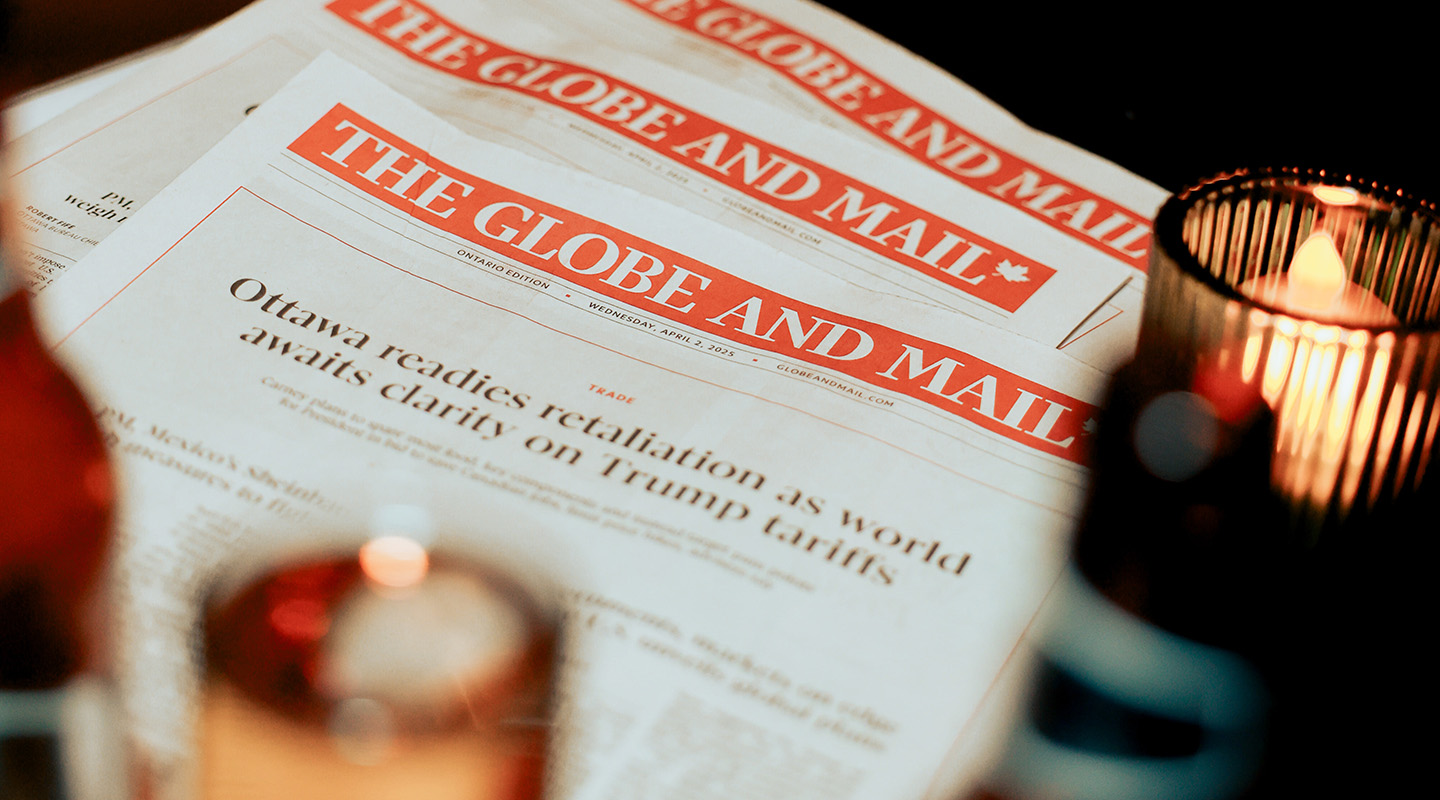

Future of News

In September 2025, The Globe and Mail and Stagwell launched the Future of News Canada Initiative with a summit at the Globe and Mail Centre in Toronto. The event brought together 200 marketing and industry professionals to explore how brands and news organizations can work more effectively together.

The initiative was anchored by original research with over 9,600 Canadians, revealing that highly engaged “news junkies” make up a significant, influential audience. The findings also debunked myths about brand safety, showing that news content – even hard news – drives purchase intent across key demographics, from Gen Z to high earners.

For advertisers, the lesson was clear: credible journalism strengthens trust while delivering real business results. Panels featuring media and marketing leaders emphasized that news is both a societal pillar and a high-value platform for brands.

Read the full research and summit recap here.

Intersect/25

The Globe and Mail’s inaugural Intersect/25 convened leaders from business, government, and media to discuss Canada’s economic, geopolitical, and environmental challenges. From CIBC CEO Victor Dodig’s call for urgent productivity reform to conversations on regulation, defence, innovation and Indigenous partnership, the forum highlighted the issues shaping national discourse.

For brands, Intersect/25 offered a clear view into shifting priorities and evolving consumer sentiment. The discussions underscored how themes of resilience, sustainability and leadership resonate with Canadians – and why aligning with them helps brands build relevance and trust.

Building on the momentum of its Toronto debut, Intersect becomes The Globe and Mail’s signature event in 2026, expanding to three cities. The flagship event returns to Toronto in April, with new regional editions launching in Calgary and Halifax in May and June, respectively, extending these conversations to more audiences across the country.

Catch up on the highlights from Intersect/25 here.

Life/Style Reimagined

In 2025, The Globe and Mail made a deliberate investment in expanding its Life and Style coverage, recognizing the growing need to balance an intense news cycle with content that reflects how Canadians live, spend, and express themselves. The result was a reimagined digital Life/Style experience that goes beyond traditional lifestyle reporting, spanning fashion, wellness, food, home, travel, and culture – without sacrificing the credibility and editorial rigour readers expect from The Globe.

This expansion responds directly to audience behaviour. As news fatigue continues to rise, readers are seeking inspiration, guidance and moments of escape alongside trusted reporting. By broadening its lifestyle lens, The Globe has created space for more positive, engaging storytelling while maintaining its role as a daily news destination. Early results showed stronger engagement, deeper time spent and increased reader satisfaction across platforms.

Style Magazine’s evolution was a key milestone in this shift. The refreshed quarterly print edition and expanded digital presence elevated fashion, design and travel coverage through personality-driven storytelling, original photography, and features like Canada’s Best Dressed List and the new Beyond travel section. The relaunch was celebrated at the Inside Life/Style Launch Party event, bringing together editorial leaders, cultural tastemakers and brand partners.

For advertisers, this investment opens up more moments to connect with a highly engaged, style-conscious audience that values trusted recommendations and premium environments. Life/Style now offers brands greater flexibility across platforms – from immersive storytelling online to high-impact print and experiential opportunities – positioning campaigns alongside content that informs, inspires and balances the daily news experience.

Learn more about the Life/Style relaunch here and lessons from our expanded lifestyle coverage here.

Young Lions Competition and Cannes Lions 2025

Canada’s rising creative stars made waves in 2025 at the Canadian Young Lions Competition, which expanded to include new PR and Design categories. Canadian winners went on to compete on the global stage at the Cannes Lions International Festival of Creativity in June, where more than 450 competitors from 67 countries went head to head. Team Canada brought home Gold in Design, Bronze in Media, and shortlist recognitions in Film and Marketers – reinforcing Canada’s position as the third most awarded country globally in Young Lions history (!!)

The competition is more than a showcase – it’s a launchpad for the country’s next generation of creative leaders.

View the 2025 winners, their standout work and explore 2026 competition details here. Registration for the Canadian Young Lions 2026 Competition is open from Jan 12 – Feb 8.

Cannes Lions 2025 also marked a major milestone for The Globe and Mail, celebrating 20 years as Canada’s official festival representative. From on-the-ground coverage and thought leadership to the launch of Le Journal Canadien, a custom newspaper created with Strategy to honour two decades of Canadian creativity, The Globe helped spotlight Canada’s impact on the global stage. Canada ranked 5th overall at the festival in 2025, reinforcing the strength and consistency of our creative community.

Additional Initiatives & Highlights

Beyond our flagship initiatives, we delivered several high-impact programs designed to inform, inspire and drive results for advertisers:

- 2025 Content Marketing Playbook: Globe Content Studio’s 2025 report distills key insights, learnings and predictions across categories from lifestyle and travel to finance and more. Focused on enduring transformations rather than fleeting trends, it’s designed to help marketers refine content proposals, map sustainable strategies and drive brand growth with every story. Download the report and see the highlights from April’s Tactics & Takeaways content marketing event in Toronto. Stay tuned for the 2026 report, dropping in February with fresh insights to help guide content marketers in the year ahead.

- The Leadership Innovation Imperative: In collaboration with the Canadian Media Directors Council (CMDC), this report examines how Canada’s top media and marketing leaders are navigating economic uncertainty, AI disruption and shifting political tides. Download the report.

- Globe Alliance: Our premium digital media network combines The Globe and Mail with publishers like CNN, Wall Street Journal and The Guardian – reaching 18.6 million Canadians through one managed buy. 2025 highlights included our CNN VIP dinner in Toronto, featuring a conversation with Andrew Coyne and John King on U.S. – Canada relations, global shifts and the future of media. Learn more about Globe Alliance here.

- Creative Studio Spotlight: In 2025, our Creative Studio partnered with brands to deliver standout campaigns across The Globe and Mail and Globe Alliance, bringing stories to life through bold formats, thoughtful design and platform-first execution. Explore our digital gallery to see the work we’re proud to put our name behind.

- Lens on the Water – A Tribute to the Ocean: The Globe and Mail and Rolex partnered on a bespoke event designed to convene influential audiences for meaningful dialogue. The evening celebrated the ocean’s vital role in our planet’s health and featured conversation photographers Shane Gross and Cristina Mittermeier, whose imagery and storytelling inspired climate action and highlighted Canada’s role in global conservation. Learn more about The Globe’s bespoke event opportunities here.

- Data and Digital Innovation: The Globe expanded audience-first measurement and contextual intelligence capabilities to help advertisers reach high-value audiences in trusted, privacy-safe environments with greater precision and confidence. Learn more here.

2025 showcased the power of bold ideas, premium journalism and audience-driven storytelling. From impactful research and global creative recognition to expanded lifestyle coverage and creative innovation, these initiatives show how partnering with Globe Media Group continues to deliver meaningful ways to reach engaged, high-value audiences across platforms, while staying at the forefront of cultural, creative, and national conversations. As we look ahead to this year, we’re excited to keep deepening trust, pushing creative ambition, and continuing to create space for the conversations that matter most to Canadians.